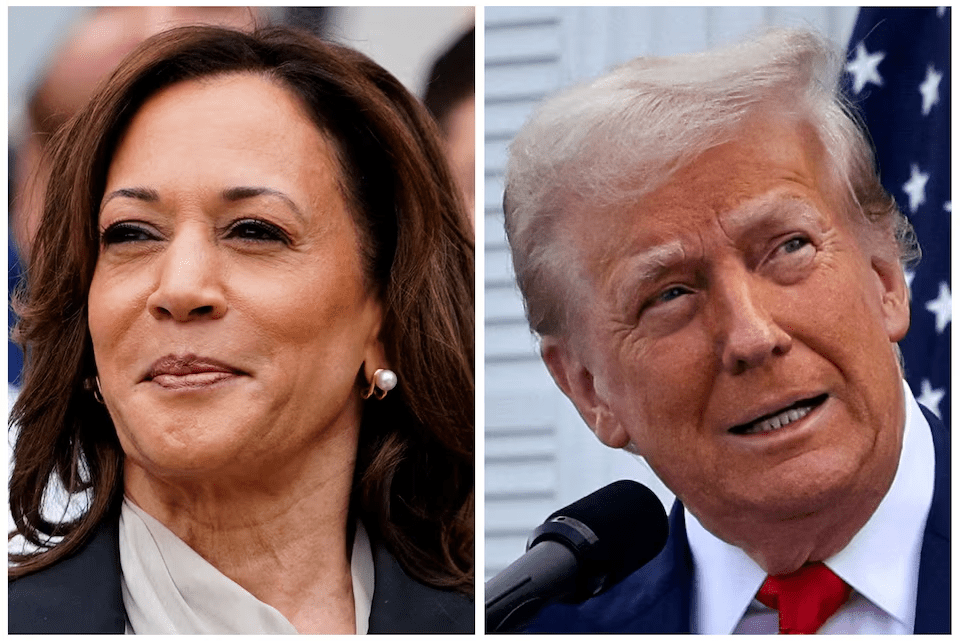

Many senior executives on Wall Street, the heart of the US stock market, are holding off on backing either of the two candidates for US president, as they are wary of both Kamala Harris and Donald Trump.

Some of their colleagues, such as George Soros, Bill Ackman and John Paulson, have already chosen their favorite, but others are still weighing the politicians’ economic programs.

They believe that despite his successful track record of implementing policies that have favored Wall Street, Republican Trump could pose a threat to economic and political stability. As he did during his first term, he has promised to cut taxes and regulations, but most managers believe that the benefits will be offset by his planned import tariffs, which could fuel inflation, while tax cuts could widen the US budget deficit. On the other hand, Democrat Harris is still an unknown player for them, she also risks becoming “too left” and may continue the tough policy of current President Joe Biden towards the largest corporations. She has so far barely touched on financial policy in her speeches, but has already promised to take a tough stance towards banks and fight hidden bank fees. Harris’s program provides for higher taxes for large companies, which will affect their income, but will reduce the projected budget deficit. Many corporations, Reuters writes, would prefer Harris to be elected president and for Republicans to control the Senate (currently dominated by Democrats). Financiers expect that such a configuration would not allow Democrats to raise taxes and would force Harris to choose moderate candidates for leadership positions.

Leave a comment